Kenya is a developing country in East Africa and borders Tanzania, Uganda, Ethiopia and Somalia, countries living in extreme poverty. On the contrary, Kenya is showing long-term economic growth due to its investments in infrastructures’ sustainability and improvements in governance and public-sector capacity. A country that is likely to escape its neighbors’ poverty, still nearly half of the 45 million inhabitants is living in it [1]. One of the reasons of the countries poverty is the lack of financial institutions and services, together with its poor infrastructure keeping the poor in poverty. By this, they cannot send money to family in debt, buy goods and services and invest in education and health, leading to a great decrease in the countries potential growth.

2007 was the year that tackled this problem. Kenya’s largest mobile network operator Safaricom launched in this year M-PESA, a money-transfer and microfinancing service for mobile phones, allowing mobile phone owners to easily transfer money to other M-PESA and non M-PESA users, pay bills and purchase mobile airtime credit [2]. Its fast growth of subscribers in Kenya to 17 million in 2011 haven’t gone unnoticed. Many other countries from various parts of the world have implemented M-PESA since its success [3]. Vodafone’s development of the M-PESA service has contributed a lot to the economic and social development of Kenya by serving the wishes of the Bottom of the Pyramid (BoP) customers.

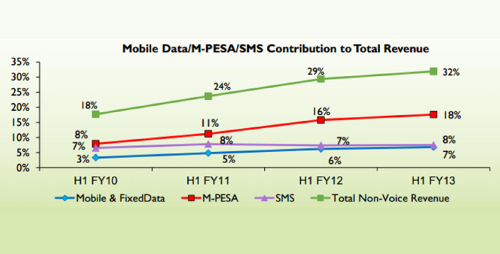

Figure 1. M-PESA's contribution to total revenue (red line)

As a frugal innovation, M-PESA shows that the wishes of these customers weigh very heavily in innovations’ and technologies’ market success in developing countries. Then how can it be that still many Western multinationals believe, as Cees van Beers, professor of Innovation Management at Delft University of Technology, mentioned in his web lecture ‘Frugal Innovation: a business perspective’, that limited purchasing power of the BoP customers cannot be translated in profitable opportunities? M-PESA is now facilitating 10% of Kenya’s Gross Domestic Product! Profitable opportunities cannot only be subscribed to the purchasing power of customers. No! It’s the art to design and innovate such a product or service that fulfils the wishes of the consumers, lowers the price and still ensures the quality. Also the second misconception of Western multinationals that there is no room for high technology firms in low technology markets is a great one. Vodafone, a large Western mobile network operator, developed the M-PESA currency system for the Kenyan market and it has become a big success! The art is not to compete with low-technology markets but to look for societal issues not yet tackled by current technologies (so creating new markets). The third conception that serving BoP costumers is considered as exploitation of the poor isn’t right either. On the contrary, M-PESA helps BoP costumers paying their bills and investing in education and health, escaping the downward spiral of not being able to finance necessary goods. Frugal innovations can thus fight poverty instead of creating it.

When you think about an African country like Kenya, you probably won’t believe everyone has got a mobile phone. Well, from now one do so, because currently 93% of the Kenyan population has one [4]! M-PESA is thus really of benefit, creating the opportunity of monetary exchange and thus contribute to the countries’ monetary system, while it’s cheap for the customers. However, if M-PESA wants to keep its Kenyan market share, it has to keep improving the currency system. The monopolist it has been for more than 5 years can now count on competition due to arising mobile network operators like Finserve Africa and Mobile Pay [5]. The government has to regulate all this in order to protect BoP’s wishes. Although there have been big investments in governance and public-sector capacity, corruption in Kenya is still a large problem. Regulating the Kenyan mobile sector will thus be a great challenge.

Sources

[1] http://www.ruralpovertyportal.org/country/home/tags/kenya

[3] https://en.wikipedia.org/wiki/M-Pesa

[4] http://elibrary.worldbank.org/doi/abs/10.1596/1813-9450-5988

[5] http://fortune.com/2014/06/27/m-pesa-kenya-mobile-payments-competition/