In order for the financial plan to work, we have to make some good estimations about the costs of building and maintaining a greenhouse. In the “PAMOJA GREENHOUSES” business plan made by a minor group consisting of Arwen, Laurens and Marc, these estimations are made. In the making of the financial plan we will make use of the estimations, which are represented in the table below.

|

|

Costs |

|

Building Cost Greenhouse |

320.000 KES |

|

Monthly Turnover |

48.000 KES |

|

Monthly Costs |

33.000 KES |

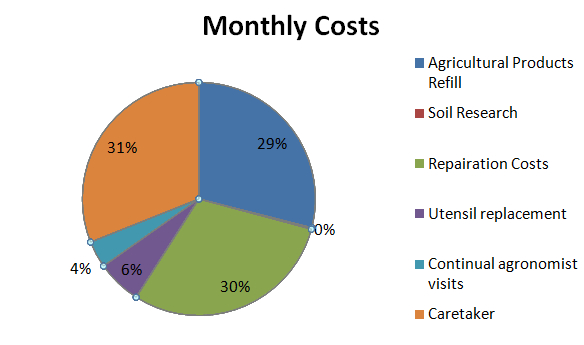

The monthly costs are specified as following (PAMOJA GREENHOUSES):

Furthermore, the current economic environment in Kenya has also been accounted for. At the moment, this report is written (October 2015) the inflation rates are, for Kenyan standards, not high at a 6 percent per year. When we look at inflation rates from the Kenya national Bureau of statistics, which is depicted in the figure below, it is seen that inflation rates have been semi-stable since 2013. However when we look at the period from 2005 until 2013, we see that inflation rates can be at a yearly average of 20 percent per year. If such a hyperinflation occurs while famers are saving for their greenhouse, their money will depreciate rapidly. This is a major liability for our project, and has to be dealt with accordingly. The average inflation since 2005 was 11%, so we will use this figure in the calculations of our financial plan.

We want the farmers the farmers to be able to buy their own greenhouse in four years. So, our famers will need to save 485782 KES in order to deal with the inflation. Our farmers will generate a monthly profit of 15.000; however, this will also increase over time when inflation is calculated. After four years, the famers will have made a profit of 897.458 KES. So, in order to for them to buy a greenhouse, they must save 54% of the profit made. The results of this assessment are depicted below. Whilst the farmers are saving for their greenhouse, they will have an income of 6940 KES. The BNP per capita in Kenya lays around 120.000 KES per year. Our project targets famers that already have some income. By taking part in this project our farmers will generate an extra income of 70% of the BNP per capita. This will also make it financially attractive on the short term. The calculations made are done in an excel plot.

Savings Plan

The easiest way to let them save the money is by depositing it on a bank. However it might be financially attractive to invest some the savings into low-risk value fixed investments because this will mitigate the depreciation of the farmer’s savings over time. However, it is really hard to determine what kinds of investments could be proper for this project. When our team is situated in Kenya, we will try to determine if such investments exist.

Furthermore, it is estimated that there will be 4 harvests per year. So, the deposits need to be done on a quarterly basis. Also if inflation stays low, the greenhouse can be bought at an earlier stage.